Large or small, retail operations must stay ahead of industry trends to survive. And 2023 was a big year in retail trends, one that saw e-commerce continue its steady rise and many big-name brick-and-mortar establishments struggle.

Major brands like Rite Aid and Nordstrom—staples of the retail space as we know it—have had an increasingly rough go of it in the current retail climate. In fact, Rite Aid was one of 4,553 retailers to have claimed Chapter 11 bankruptcy as of October 2023. Countless more retail giants have closed stores or laid off employees in big numbers.

This environment of fear and uncertainty is showing up on both the customer and retail operator side of things. Retailers like CVS are dealing with rows of empty shelves due to supply chain difficulties. On the flip side, more retail customers are choosing generic products over name-brand items or resorting to shoplifting if all else fails.

These are just a handful of the pressing issues on retailers’ minds in 2024. They’re also focused on adapting to changes in how customers consume advertisements, growing sustainability initiatives, and navigating the ever-evolving role of AI in retail.

NP Digital wanted to get a sense of where the industry is headed in 2024, so we went straight to the source—industry professionals. We asked them about the key trends and developments they see shaping retail in the year ahead. We hope their unique insights can help you create winning strategies in 2024 (and beyond). To share these insights with your team, be sure to download a copy of the report as well.

Table of Contents

- Data Methodology

- Key Points

- The Retail Landscape: E-Commerce, Brick-and-Mortar, or Both?

- How Retailers Are Adapting to the Economy

- The New Face of Retail Marketing in 2024

- AI In Retail In 2024: Where Is It Going?

- Insights for Digital Marketers on Retailer Trends

- Conclusion

Our Data Methodology

To collect this data, NP Digital surveyed 1,000 retail professionals across the U.S. Each survey participant fell into one of three categories:

- Retail manager

- Retail owner

- Retail employees involved in marketing or advertising

Our goal is to show insights into how these professionals view the overall retail trends, specific challenges, and their action plans to combat the current obstacles and seize upcoming opportunities.

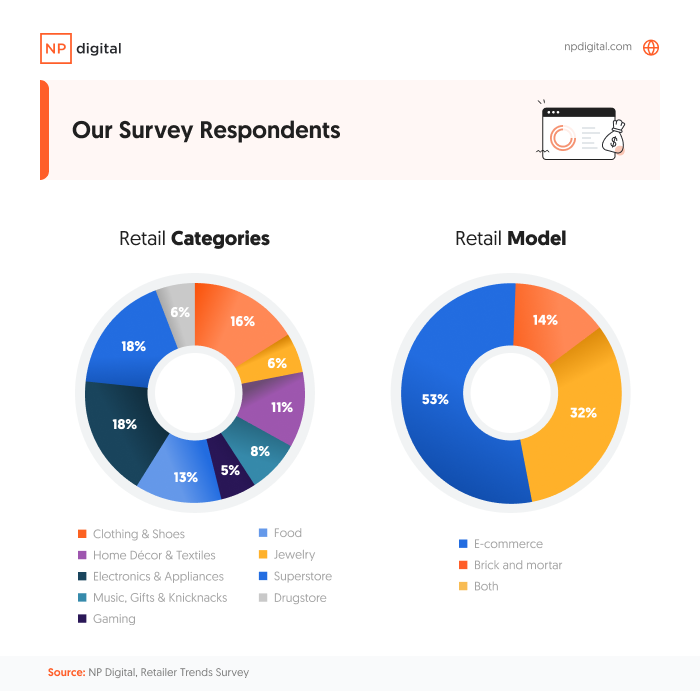

Our pool of participants spans a range of industries, and the breakdown looks like this:

- Electronics or appliances – 18%

- Superstore (e.g., Target, Walmart) – 17.5%

- Clothing and shoes – 16.2%

- Food – 12.7%

- Home décor and textiles – 11.3%

- Books, music, gifts, and knickknacks – 7.6%

- Jewelry – 5.8%

- Drug store (e.g., CVS, Walgreens) – 5.6%

- Gaming – 5.3%

Key Points

- Over 50% of brick-and-mortar retailers surveyed see theft as a major concern in 2024.

- Almost half (48%) of retailers are seeing brick-and-mortar rent increases cut into their profitability.

- More than 75% of retailers are examining ways to overcome staffing challenges in the new year.

- 35% of retailers from our survey see strengthening brand loyalty as a winning strategy in 2024.

- 51.9% of retailers are considering a shift to shared retail space to strengthen a sense of community and experience the benefits of cohabiting a space with more established businesses.

- Over half (52.6%) of respondents plan on leveraging AI to make product recommendations for their customers.

The Retail Landscape: E-Commerce, Brick-and-Mortar, or Both?

Among the most glaring retail trends in recent years has been the shift from brick-and-mortar to online models. E-commerce has created a pathway for new brands and small businesses to flourish, while companies that were unable or slow to embrace the digital shopping model have struggled.

Our survey data shows just how much the retail landscape has shifted in a digital direction, with 53.7% of participants operating a purely e-commerce model and 32% taking a hybrid approach.

Companies reluctant to embrace this shift have been hit the hardest. Bed Bath & Beyond is a prime example. One of Bed Bath & Beyond’s primary challenges was its reliance on paper “snail mail” marketing and promotions. The company’s use of paper coupons was a genius strategy for short-term gains but didn’t do much for growing brand loyalty—especially in the digital age.

Those dated marketing efforts and general difficulties in adopting the digital sales funnel (and its evolution into omnichannel marketing) were two main factors the business has had to work to overcome.

Bed Bath & Beyond serves as a cautionary tale to retailers. Adapting to the digital landscape is necessary to ensure their survival.

Retail Theft: How Is It Impacting Brick-and-Mortar?

Let’s take a closer look at retailers’ anxiety over the rise in theft, which is projected to cost retailers as much as $140 billion in revenue in the coming years.

According to our internal survey results, only 9.9% of participants expressed “no concern at all” about theft. Over 50% of brick-and-mortar retailers say they are concerned, with 20% being in clothing or shoes and 19% working in superstores.

An example here is Target, where theft is escalating to unprecedented levels. The retail superstore is set to close nine stores, citing safety concerns and retail theft as the reasons.

But Target isn’t the only victim of this growing retail industry trend. In downtown San Francisco, businesses like Nordstrom’s, Saks Off 5th, and Anthropologie have also been the target of shoplifting incidents. The most recent organization to join this list in the local area is Old Navy.

Old Navy was recently hit with a spree of 22 shoplifting incidents over a two-day period. As a result, the business chose not to renew its lease on a 72,000-square-foot location in downtown San Francisco.

It’s no surprise that larger big box stores—with more ground to cover and relatively less staff to cover it—struggle with retail theft. But what about small to medium-sized businesses?

Recent data shows that 85% of small businesses report being the victim of theft at least once per year. This is one of the many reasons it’s becoming easier to run an e-commerce or hybrid business profitably than a brick-and-mortar.

Are Rent Prices Driving Brick-And-Mortar Away?

More than 70% of our survey respondents said they saw an increase in their brick-and-mortar rent over the last year. On top of that, 48% of respondents said these rent increases are hurting their profits.

Although rents are rising, just as many businesses are choosing to stay open as those choosing to close their doors. According to our survey data, 41.7% will stay open, while 37.8% of retail businesses are choosing to close their doors.

A closer examination of our data suggests that split isn’t so even. Of our 48% of participants who say rent is hurting their profits, two-thirds are considering closing their brick-and-mortar storefront. This is despite the fact nearly 30% of these retailers say they get a great deal on rent.

Some retail operations are considering shared retail space to avoid closing their doors. About 56% of our survey participants are contemplating sharing a physical location with another store. More on this later.

Ultimately, a “good deal” or declining rental prices may not be enough to keep physical retail locations open. Persistent issues like consumers’ growing preference for digital shopping and the recent rise of theft may make it challenging for retail organizations to stay open regardless of rental prices in the near future.

Staffing Problems in Retail

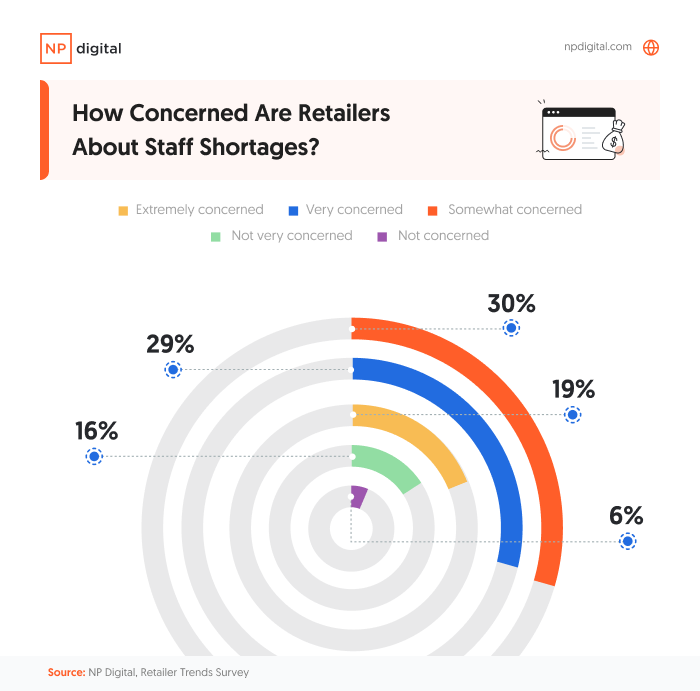

As if dealing with rental challenges weren’t enough, a staggering number of retail businesses are also dealing with staffing problems. Over three-quarters (77.6%) of retail professionals range from somewhat to extremely concerned about staffing. Nearly a third of these businesses (30%) have trouble hiring, and 29% flat-out say they’re short-staffed.

What’s compounding the staffing issues is the fact that 19% of retail operations can’t fill open roles. Those feeling this most are superstores like Walmart and Target. Superstores accounted for 25% of the businesses with problems filling open roles, while electronics and appliance businesses represented another 20%.

One of the major challenges here is a disconnect between on-the-ground managers and upper-level corporate management. Over half (51.7%) of store managers have concerns about staffing, while only 37.5% of owners express the same sentiments.

The good news is that these staffing shortages aren’t insurmountable. The bad news is that retail operations need owners to improve communication and get on the same page as ground-level store managers to make any sort of progress. It could be a slow process, but improvement is possible.

Opportunity: Shared Physical Spaces

Companies sharing physical retail space is among the recent trends in retail around sustainability. Real-world examples might be a Starbucks or Ulta inside a Target or a co-op of multiple vegan businesses working out of a shared location.

Shared retail space has several advantages, including reduced utility expenses and rent costs. These benefits have driven growth in shared retail setups. In fact, 53.6% of our survey participants with some form of brick-and-mortar presence already operate from a shared retail space or are currently pursuing one. Superstores, electronics/appliance stores, and clothing/shoe retailers are the frontrunners in embracing shared setups.

For superstores, this trend may be less about sheer survival and more about providing the best customer experience and maximizing brand loyalty. The longer you can keep customers in your store, and the more of their needs you can meet in one physical location, the longer they’ll stay and the higher their lifetime value becomes.

Interestingly, the businesses most interested in this setup are those with a hybrid brick-and-mortar and e-commerce presence. Over half (53.9%) of the solely brick-and-mortar businesses in our survey said they wouldn’t want to pursue this model, probably because it would be a logistical struggle.

How Retailers Are Adapting to the Economy

Retailers have to stay ahead of the curve and be aware of emerging trends more than other business sectors. A shift to online and social media shopping and AI’s impact on how people browse the internet is beginning to drastically reshape retail.

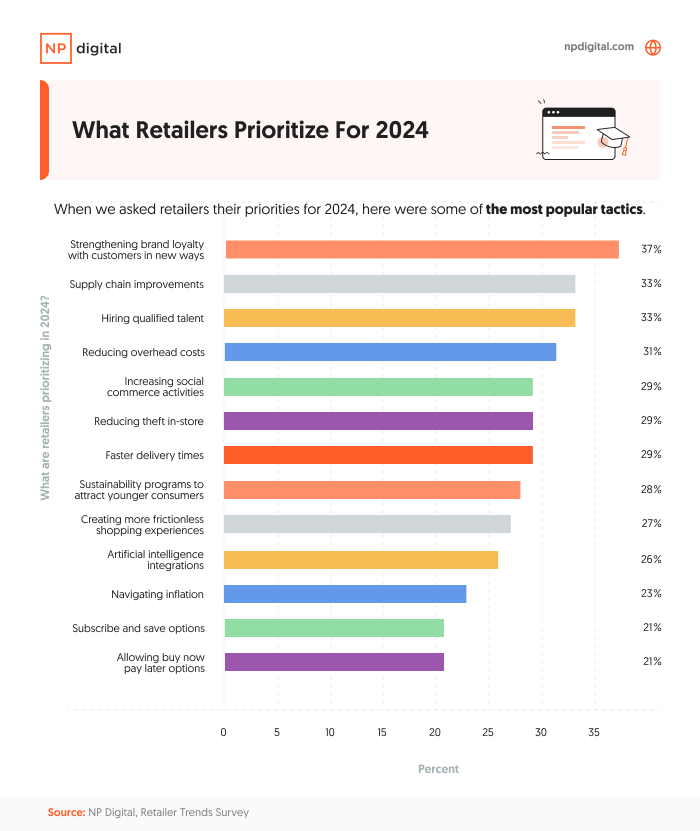

Here are some areas we see retailers focusing on in 2024—based on our survey data.

Brand Loyalty: Why Retailers Are Focusing on It

An emerging retail trend that’s sure to persist in 2024 is a focus on strengthening brand loyalty. Over 35% of the retailers from our survey say this is a priority moving forward.

This trend is even more apparent in businesses with female leadership. According to survey data, 40% of women respondents feel brand loyalty is a top priority, versus 34% of men. As the number of women in leadership roles grows, this could mean a shift toward business priorities that have traditionally been underserved.

With issues like labor shortages, supply chain issues, and inflation affecting businesses worldwide, why focus on something like brand loyalty? The short answer is that it’s much easier to control for business owners. Retail companies may believe that strengthening customers’ connection to their brand can offset the adverse effects of other market trends.

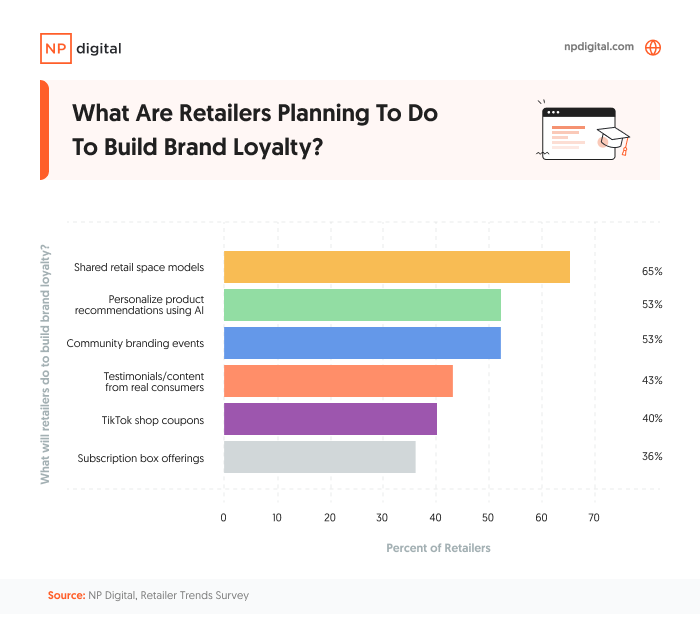

How do businesses plan to build brand loyalty? Well, our survey revealed several strategies business plan to deploy, including:

- 43% are going to use testimonials/content from real consumers in their ads

- 40% plan to offer TikTok shop coupons

- 55% are going to use AI to personalize product recommendations to their customers in 2024

- 52% are planning on doing community branding events

- 36% are implementing subscription box offerings

- 65% currently have or are considering a shared retail space model

- Of this 65%, 44% are doing it as a way to strengthen a sense of community

Building Retail Community

Most retail brands feel that brand loyalty and a sense of community go hand in hand. Among the retailers we surveyed, 37.8% say community events like pop-up shops or concerts are pillars of their brand loyalty strategy. Of that nearly 40%, 51.4% say strengthening brand loyalty is their highest priority in 2024.

Roughly the same percentage (51.9%) are considering a shift to a shared retail space to foster community and experience the intangible benefits of working alongside other reputable businesses.

Businesses say corporate responsibility also factors into this approach. Almost 80% (78.4%, to be exact) of our survey participants consider a shared retail space a giant leap in their sustainability efforts.

Retailers Are Experimenting

One silver lining we see from these retail trends is that retailers show no fear of experimenting in the face of economic challenges. About half of those we polled plan to work with influencers to co-brand products as a way to generate sales and power through these economic struggles.

This is a new, rising trend in the influencer economy, where current celebrities are not only marketing products but partnering with brands to co-create them. Some examples include Mikalya and e.l.f. and Kim Kardashian and Boohoo.

The co-branding retail trend reaches far beyond these two mainstream partnerships. Within our survey, we see that 19.6% of electronics or appliance businesses are exploring co-branding opportunities. Superstores are the next biggest sector to go this route, coming in at 18.8%. The third biggest group taking co-branding experimentation into 2024 is clothing and shoe businesses, at 17.6%.

It should come as no surprise that many e-commerce brands will continue to rely heavily on co-branding in the new year. What’s more shocking, however, is that retail industry sectors like home décor (11.8%), food (8%), and jewelry (5.9%) are not really investing much in co-branding at all.

Social Commerce

Social commerce is a rapidly growing retail trend that should be on retailers’ radar. It involves selling to customers directly through social media platforms.

The most astonishing fact we find from our survey is that 0% of brands are not using social commerce. Every retailer in our poll is leveraging social media to build their brand and convert post-viewers into sales. Of these brands, 91.4% are generating revenue and customers from their social commerce efforts. Almost two-thirds (64.3%) claim their social efforts are very valuable or invaluable to their success.

A closer look at the marketers or advertisers who took our survey shows the importance of social commerce. A third of our marketing and advertising respondents placed social commerce efforts as a high priority for their team, even above brand loyalty.

Marketers truly understand the value of social commerce. And anyone not using it in their business is lagging.

Sustainability Initiatives

Much like social commerce and brand loyalty, sustainability is another top priority of the retailers in our survey. Almost 40% (38%) are making sustainability a major priority, and 28% have it as a top priority for 2024. Less than 10% said that they wouldn’t make it a priority in the coming year.

The largest segments of our survey focusing on sustainability are superstores (19.5%), Electronics stores (19.4%), and clothing or shoe stores (16.3%). These retailers view shared space as a way to further their sustainability efforts by lowering operating costs and environmental footprints.

The New Face of Retail Marketing in 2024

Current advertising budgets are a tale of two extremes. Most businesses are working with budgets of more than $200,000 or less than $20,000. There isn’t much middle ground.

Our survey uncovered that electronics had the highest budget of the less-than-$20,000 group. Their ad spend came in at 21.3% of expenses. Over half of that goes toward e-commerce advertising.

One promising retail trend we see in businesses with lower marketing budgets is they still plan to expand their experimentation in 2024. Just over 40% of the low-budget group plans to try platforms they’ve never advertised with before.

This may be because the stakes are lower with budgets of less than $20,000. Since marketing costs are lower in this budget range, retailers are more open to trying different strategies. Additionally, 58.4% of this smaller budget group are thinking about lowering the prices of their offerings to help marketing efforts.

The over-$200,000 group behaves a little differently. Naturally, superstores are the largest portion of this group. Many of them (45.2%) are concerned with recruiting quality talent. Somewhat surprisingly, even more members of this group (64.3%) are thinking of cutting prices on their products.

The overall trend shows that superstores, with their larger budgets, can spend more money on large-scale brand awareness advertising aimed at a much larger audience.

Conversely, the smaller businesses focus on finding their niche, running more targeted campaigns, and experimenting with different tactics. Regardless of strategy, all brands seem to feel the squeeze of the economic climate and plan to adjust prices accordingly.

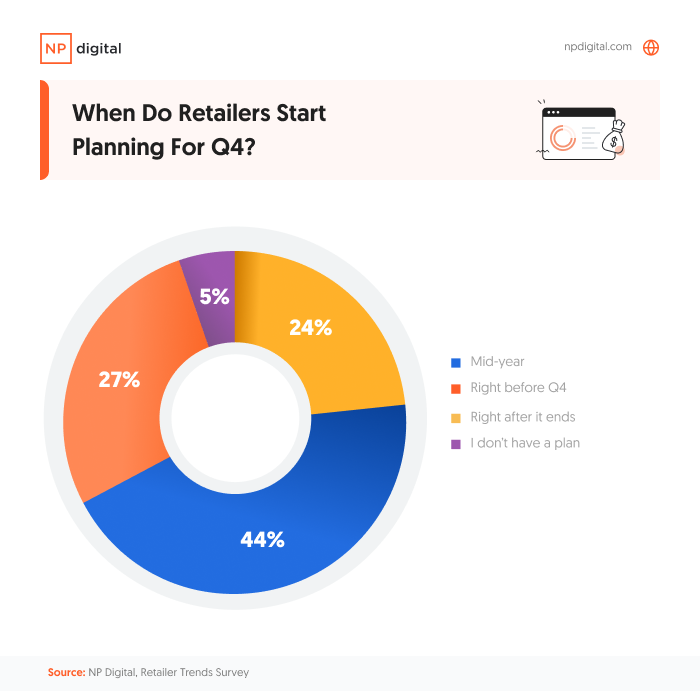

How Retailers Plan for Q4 and What Is Changing

Q4 is an essential time for retail businesses. The holiday season—when the world does most of its shopping—makes up the bulk of Q4. Retailers in all sectors want to have their promotions, pricing, and planning in order as soon as possible.

For that reason, most savvy retail operations (43.8%) begin Q4 planning midyear. Almost a quarter of respondents (24%) said they start planning for the next year right after the current one ends.

Based on the data, most retailers in our survey seem unhappy with their current Q4 planning timeline. And 27.5% of businesses surveyed admitted to being last-minute planners.

The majority of businesses surveyed wanted to keep their marketing budget the same in 2024. They might be reluctant to make big shifts in spending in the current economy, or they may not have the wiggle room in their budget to adjust much.

Either way, the overarching retail trend points to somewhat stagnant budgeting entering the new year.

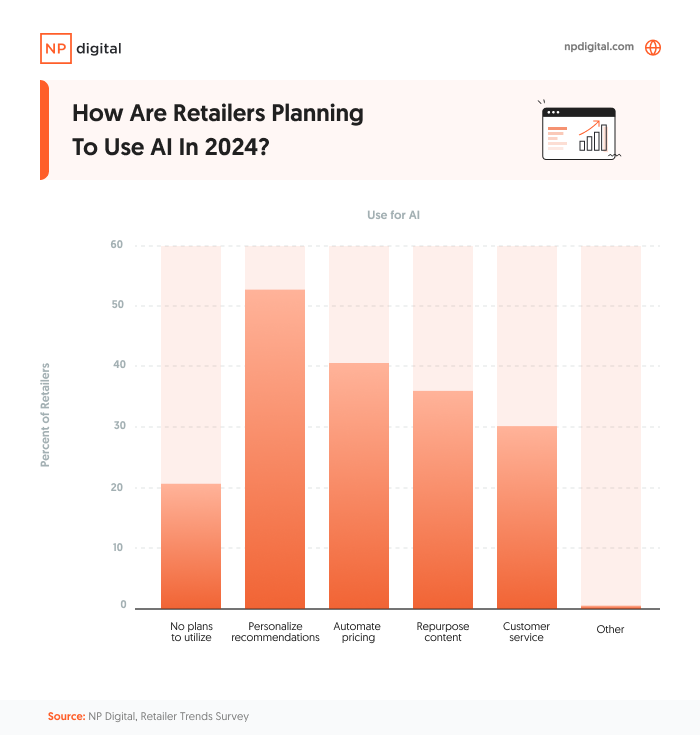

AI In Retail In 2024: Where Is It Going?

AI has taken the world on a wild path. From creating marketing calendars to fully launching mobile apps, production teams from all corners of modern business have found ways to leverage AI automation to improve their output. The launch and evolution of AI chatbots have turned many industries on their heads.

Retail businesses can explore AI from a number of angles. Right now, most are using it for product recommendations (nearly 53%), according to our data. But AI can be used to generate marketing creative on platforms like Midjourney and ChatGPT.

In a 2023 NP Digital survey on AI in digital marketing, marketers said they felt most comfortable using AI in the following areas:

- Creating partial content

- Assisting with research

- Assisting with outlines

- Brainstorming

- Editing assistance

- Schema creation

As technology advances, this list will only grow—both in the retail marketing space and beyond.

But not all retail companies are rushing to embrace the new technology. Our survey results show that 20.6% of retailers are not planning to use AI, suggesting there’s still some anti-AI sentiment in the industry. That sentiment more than doubles (42.7%) when we zoom out to solely brick-and-mortar businesses.

As AI platforms become more advanced, retailers can rely on them more and more to streamline workflows. Whether it’s creating marketing schedules, coming up with new ad copy, or producing new ad creative, we may begin to see AI used more regularly by retailers across the board.

Insights for Digital Marketers on Retailer Trends

If you’re feeling economic anxiety, you’re not alone. Most retailers are worried about things like staffing woes and inflation, impacting their ability to run their businesses. Brick-and-mortar businesses are also heavily questioning the value of keeping their operations as is. The exceptions are industries like food and beverage that may not have a clear e-commerce pathway yet.

So, what can retailers do to stay ahead of these issues? This is where our data pointed us:

- Prioritize what you can control. Building brand loyalty and community, in their minds, creates a customer base that can weather storms—both economic and otherwise.

- Embrace technology and innovation. Necessity is the mother of invention, with many retailers taking their marketing plans into new places (AI-generated creative, co-branded products with influencers) to try and draw in or retain customers. Things like AI, social commerce, and sustainability, once seen as fads, are a bigger part of the fabric of society than we originally thought. Retailers would be smart to factor them all into future marketing plans.

- Sustainability matters. Eco-conscious consumers are turning to retailers that reflect their values around sustainability. Promoting sustainable practices—like occupying shared spaces—can resonate with today’s shoppers.

- Experiment with emerging tech. New technologies like AI provide opportunities to get ahead of retail trends or improve customer reach and engagement in novel ways. Retailers should stay on top of tech trends and consider strategic experiments.

- Lean into influencer collaborations. Partnering with relevant influencers on social media or in-store events can help retailers reach new audiences. Authentic co-created content tends to perform well.

Conclusion

A lot of new retail trends and concerns are driving the current decisions some companies are making. Here are some of the key items to keep in mind:

- Fear is a major motivator for retailers right now, especially in the brick-and-mortar segment, where rent prices and retail theft are causing financial constraints.

- With the economy uncertain, a lot of retailers are looking to try and build long-term, loyal customers by reinforcing their brands.

- Retailers are being innovative to try and manage the ups and downs of the market, turning to new technology like AI as well as new business practices like shared spaces and partnerships with influencers.

While this isn’t the best place to operate your business from, all hope is not lost.

Marketers can help retailers get out in front of these trends and give their businesses the best chance to succeed. They can directly help build retail marketing campaigns or indirectly guide retailers in addressing these fears and trends with their messaging. The mentality of helping, not selling, is key for marketers to build relationships with retailers in ned.

Here are some of the key items where marketers can contribute to helping manage these fears:

- Build campaign ideas around sustainability, safety, and commitment to social issues. These ideas are on a lot of retail customers’ minds, and retailers themselves have taken notice. Start thinking of campaign ideas that can help retailers show they care about the causes their customers do.

- Be ready to innovate your local SEO/marketing packages. Retailers currently paired in a shared space with another retailer might also want to pool together their marketing budgets. Start thinking about ways that you can service multiple businesses in the same location.

- Be ready to answer questions about AI. Most retailers are already experimenting with it in some shape or form, so you should be able to communicate how you can use it to their benefit in the marketing world.

- Get your brand-based case studies ready. In an uncertain economic landscape, retailers are looking to brand loyalty to carry them through. If marketers can show that they help clients in key areas like engagement and brand-related traffic, this will help win business from retail clients.

While there may be uncertainty in the marketplace, retailers can put themselves in the best position by being proactive and using the right resources. Explore emerging technology like AI and work with marketers who have experience in your specific retail niche.

You might be surprised by where your business can go by embracing both.

What do you think will be the biggest retail trends of 2024?

See How My Agency Can Drive More Traffic to Your Website

- SEO - unlock more SEO traffic. See real results.

- Content Marketing - our team creates epic content that will get shared, get links, and attract traffic.

- Paid Media - effective paid strategies with clear ROI.

Are You Using Google Ads? Try Our FREE Ads Grader!

Stop wasting money and unlock the hidden potential of your advertising.

- Discover the power of intentional advertising.

- Reach your ideal target audience.

- Maximize ad spend efficiency.